Bretton Woods system. Other overseas central banks weren't prepared to help the dollar, which would have offered the equivalent of deposit insurance. At this time, the monetary change price between countries was managed by the Bretton Woods system, which connected currencies to the U.S. Rather than having to arrange separate accounting systems, banks, and so on. for transactions in nations other than their native one, the euro makes it easy to function from a single central accounting office and use a single financial institution. Billions were spent not only producing the brand new foreign money, but in changing over accounting techniques, software program, printed materials, indicators, vending machines, parking meters, cellphone booths, and every different type of machine that accepts foreign money. The prospect of financial shock is one other danger that comes along with the introduction of a single foreign money. In addition to the prospect of financial shock inside Euroland international locations, there can also be the chance of political shock. Interest charges for all of Euroland are controlled by the European Central Bank. Banks can offer monetary merchandise (loans, CDs, and many others.) to nations throughout Euroland.

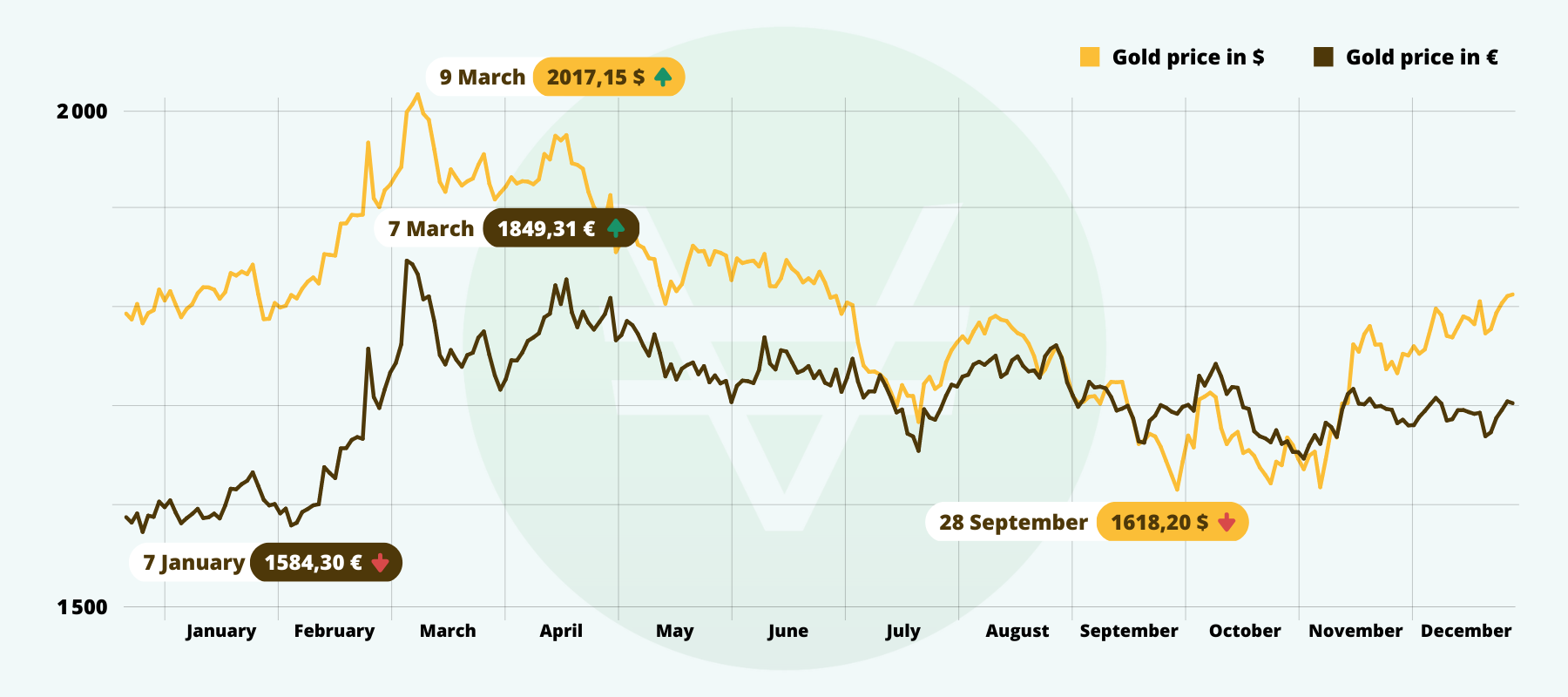

So where did that depart the European nations when it got here to the stability of their currencies? The subsequent transfer toward a unified European economic system got here with the 1987 Single European Act. The Werner Report came out in 1970 and particularly introduced up the thought of a single European foreign money as a part of a cooperative monetary effort. Structural reform for European economies - The participation requirements of the euro pushed many EU member states who wanted to participate to get their economies in shape and improve their economic development. Due to the Stability and Growth Pact, governments are restricted to retaining their budget deficits inside the requirements of the pact. Financial market stability - On a bigger scale, the financial and inventory exchanges can checklist every financial instrument in euros fairly than in every nation's denomination. Market survey is obligatory to regulate the several types of trends that gold could endure available in the market. 1st the spot marketplace for some commodity, including few base metals and valuable metals, is dominated by business in London, which means that governmental fixing rates have less time to answer day by day developments within the United States because of the five hour time spacing.

So where did that depart the European nations when it got here to the stability of their currencies? The subsequent transfer toward a unified European economic system got here with the 1987 Single European Act. The Werner Report came out in 1970 and particularly introduced up the thought of a single European foreign money as a part of a cooperative monetary effort. Structural reform for European economies - The participation requirements of the euro pushed many EU member states who wanted to participate to get their economies in shape and improve their economic development. Due to the Stability and Growth Pact, governments are restricted to retaining their budget deficits inside the requirements of the pact. Financial market stability - On a bigger scale, the financial and inventory exchanges can checklist every financial instrument in euros fairly than in every nation's denomination. Market survey is obligatory to regulate the several types of trends that gold could endure available in the market. 1st the spot marketplace for some commodity, including few base metals and valuable metals, is dominated by business in London, which means that governmental fixing rates have less time to answer day by day developments within the United States because of the five hour time spacing.

Women who donate an egg are paid between $5,000 and $8,000 for the time and discomfort of the method. The funding in real property is not solely a secure investment, nevertheless it additionally has the potential to provide higher returns over the course of time whereas still permitting you to keep up your current stage of revenue if you select to make use of the house as a rental property. The additional that Europe goes backwards in its economic attempts to show things across the larger the potential for gold's price to rise. There'll at all times be the potential danger that a member nation might collapse financially and adversely affect all the system. On a macroeconomic degree, fluctuations have previously been controllable by each nation. Neighbors and kinfolk, particularly those who've been down this street earlier than, might need useful options. Google Nexus 7 and even media gamers like the Kindle Fire would possibly help fill the void partially. Probably the things that may then fall in your head!